Small Businesses Boosted by GOP Tax Cuts

Small Businesses Boosted by GOP Tax Cuts

Small businesses are the engine of the American Dream. The passion, grit, and work ethic that entrepreneurs bring to their communities form the cornerstone of free enterprise and the backbone of our economy. In the US, there are 29.6 million small businesses that employ over 57 million individuals. The state may be home to some massive corporations, but it is this small business community that drives job creation and growth.

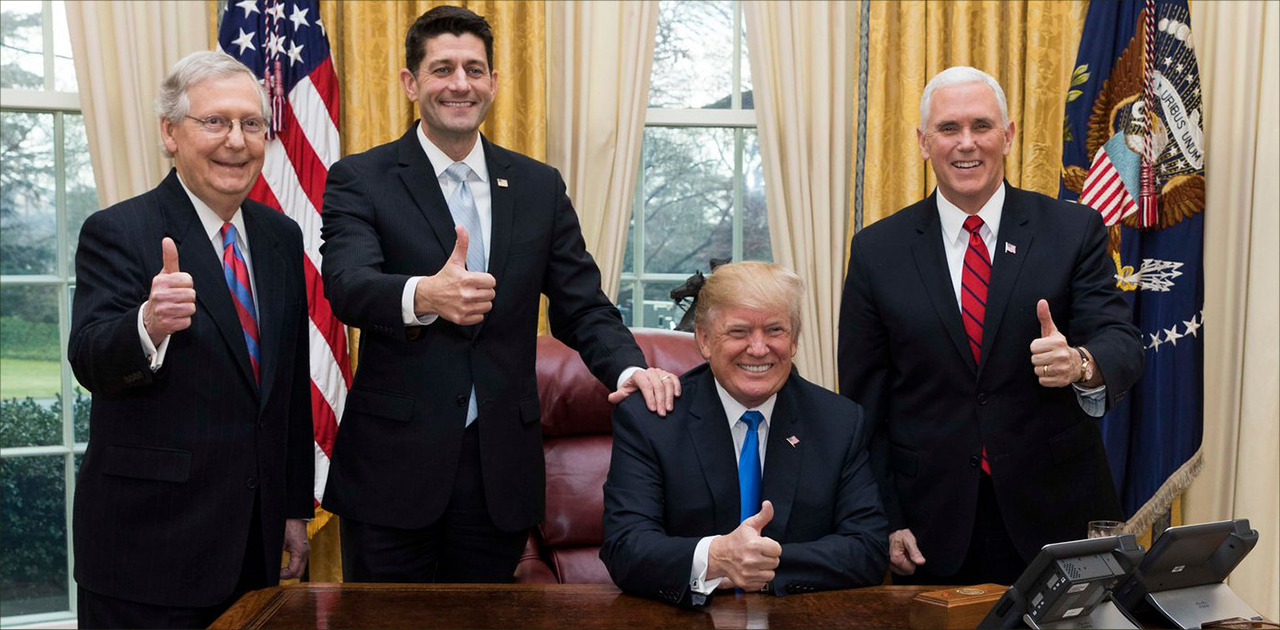

The past decade has not been easy for small-business owners. They have struggled with recession and a Democratic president that shaped an environment where more businesses were closed than opened for the first time in 35 years. These business owners made their dissatisfaction clear in 2016, when they helped elect a Republican congress that championed small business. Led by Donald Trump, the GOP passed monumental tax reform to simplify the tax code, relieve small businesses, and help American families save more of their hard-earned money.

How GOP Tax Cuts Help Small Business Owners

20% deduction

The most obvious benefit for small business owners is the new Qualified Business Income (QBI) deduction for pass-through businesses, or the “20% deduction”. The GOP targeted this as an area of our economy that was due for relief because 95% of businesses in the United States are pass through, and that is widely because it is a structure that favors the up-start mom & pops and other various small businesses.

So, how exactly does the deduction work?

If you’re married and your taxable income is less than $315,000 per year ($157,500 if you’re not married), the deduction is simple: take your business profit (net profit from a business that flows from your Schedule C, E, or F) and claim a deduction for 20% of that amount. It’s really that easy. Therefore, your businesses taxable profit is reduced by 20%.

Consumer Confidence At 18 Year High

America is emerging from the slowest recession recovery in our history, and consumers are finally starting to gain confidence in the direction of the economy. The Consumer Confidence Index is based on households' plans for major purchases, and this index is at its highest level since 2000.

This is great news for small business, because there is a direct correlation between consumer confidence and consumer spending. This increase in consumer spending is already being felt, as small business owner’s optimism was at a record high coming into 2018- largely due to tax reform and the GOP’s commitment to slash burdensome regulations.

Doubled Property Expense Deduction

Small business owners can now expense up to $1 million in business property purchases each year, doubled from $500,000 under the old tax code. Before, spending on business property was capitalized and depreciated in a way that spread the tax benfits out over several years, but now you can take the tax break immediately (if the property is placed into service).

This tax break can be used on new or used equipment, furnishings for non-residential property, heating/AC, roof improvements, and alarm systems. The GOP wanted to make sure that this tax break was small business specific, so if a business spends more than the $2.5 million for business property during the year, the ability to use the $1 million deduction will be reduced “dollar for dollar” above that amount.