Setting the Stage: End the Crude Oil Export Ban

Setting the Stage: End the Crude Oil Export Ban

By: Patrick Hedger - Policy Director, American Encore

If you ask the average American today what country is largest producer of oil, most would probably name a Middle Eastern country like Saudi Arabia or some might even say Russia. If you asked them this question just a couple of months ago they would probably be right. Today they are totally wrong. It may surprise many Americans that today America is the world’s largest producer of crude oil.

That is great news and would probably be a welcome surprise to whomever you had asked. What may be even more surprising however is the fact that federal law makes it illegal for American companies to sell all that crude oil overseas, even to our allies. How does that make any sense?

The honest answer is that it doesn’t. The ban on oil exports stems from a series of pretty bone-headed policies of the Johnson, Nixon, and Carter years. Massive increases in federal spending during the Johnson and Nixon administration were monetized. Basically the government printed money to pay for its new spending instead of raising taxes or cutting spending elsewhere. This resulted in high levels of inflation, resulting in price increases across the economy. In an attempt to combat these price increases, price ceilings were put in place for commodities like gasoline. The price ceilings kept the price of gas artificially low resulting in two things:

1. People consumed too much gas and

2. Gas companies stopped producing it for the domestic market.

Initially the oil companies tried to get around the price ceilings by exporting their product. In response, the government banned oil exports. The export ban also reflected fears at the time that the world was running out of oil. President Carter himself was convinced the world would run out of oil in 2011. Today, estimated global oil reserves are larger than ever before.

Regardless, the result of these policies was gas shortages and gas lines. President Reagan repealed the price controls and some semblance of sanity returned to the fuel market, yet the export ban remained in place.

Those familiar with the workings of global markets know that the US dollar is the world’s dominant reserve currency. This means, in part, that nations conduct trade with one another, including the trade of crude oil, in US dollars. Yet this status is increasingly in jeopardy since major trading nations like China and Russia are slowly but surely de-dollarizing. This weakens the value of the dollar. While some will say this strengthens US exports, which to be fair it does, it also decreases the purchasing power of American citizens in an increasingly liberalized world economy. In short, a weak dollar means you can purchase less with the dollars you already have and therefore you are poorer than if the dollar was strong. So how does all of this relate to exporting crude oil?

It’s simple. If the US becomes a dominant supplier of crude oil to the global market, nations and international corporations will have to buy dollars in order to purchase oil from US firms. Of course, because of the reserve currency status, people already have to buy lots of dollars in order to purchase crude oil on the global market; however allowing US crude oil to enter the global market would only drive dollar demand even higher, increase the currency’s value, and slow, or potentially reverse, the impacts of de-dollarization by nations like China and Russia.

On top of increasing our purchasing power on the global market and making goods cheaper for Americans, there is another way that ending the ban on US crude oil exports can help the average American: lower gas prices.

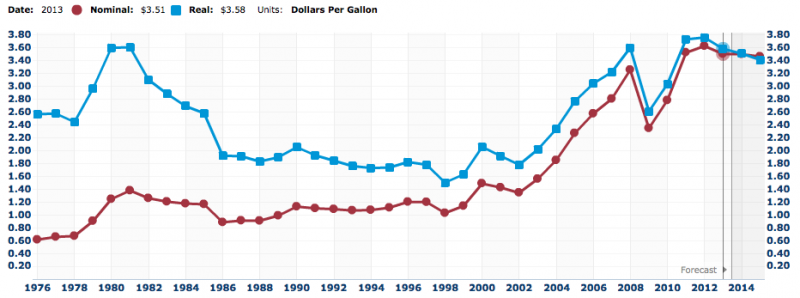

America’s pain at the pump has turned into a lingering injury. In real terms, which means adjusted for inflation, Americans are paying as much for a gallon of gasoline now as they were during the peak of the energy crisis of the 1970s and early 80s, when gas lines stretched down the block and around the corner. What gives? Didn’t I just say that America is the world’s leading producer of crude oil?

Our new title has certainly helped a little. Prices have fallen a bit over the last few years, but as you can see in the chart below they are still at near record levels:

There is no silver bullet to solve this problem. A number of things are aggravating the situation, including policies like the Renewable Fuels Standard (RFS), which is a government mandate that requires an increasing amount of corn ethanol and experimental biofuels to be blended into the nation’s fuel supply. The RFS is wreaking all sorts of havoc, which I’m sure I’ll get around to discussing in depth soon. For now you can read more about the RFS, and other problems pushing gas prices higher, here in a column I wrote for the Libertarian Republic. Other good resources on the RFS can be found here, here, and here.

So while clearly there are a number of issues and poor policies that need to be addressed in order to alleviate the situation at the pump, at least two recent studies have found that lifting the ban on exports of crude oil could help. Per Robert P. Murphy, the Senior Economist at the Institute for Energy Research:

“[A] Resources for the Future study estimated that removing the export ban would lead to a 2 to 5 cents per gallon reduction in gasoline prices for Americans. (Note that the RFF study more realistically modeled the refinery sector, and allowed for the possibility that world crude prices could go up or down—but either way, the increased efficiency in refining and greater total crude production would lead to lower gas prices.) Similarly, an IHS study estimated that removing the export ban would reduce American pump prices an average of 8 cents per gallon from 2016 to 2030.”

The Resources for the Future and IHS studies can be found here, and here respectively.

The reason for this drop in gas prices from lifting a crude oil ban may seem counterintuitive. Critics will say that the ban on crude oil exports benefits the American gasoline consumer by keeping crude oil prices low. This is true in part, but keeping crude oil prices low for domestic crude oil consumers does not help the average American. Why? Well, to start, the average American doesn’t consume crude oil; they consume refined fuel products like gasoline. Refineries consume crude oil and they are the direct beneficiaries of the demand suppression of the crude oil export ban.

The American people at large do not benefit because trade restrictions on gasoline and other refined fuel products do not exist. This means that gasoline prices in America are set by global market conditions. Refineries in the United States make maximum profit by using artificially inexpensive domestic crude oil and sell their gasoline on the global market for a higher price. Meanwhile, Americans consume imported gasoline that they can purchase at a lower price. All the while the crude oil export ban discourages American oil producers from maximizing production. Essentially, only foreign gasoline consumers benefit from America’s self imposed oil export ban. Again, Robert P. Murphy of the Institute for Energy Research offers a far more in-depth explanation of this phenomenon here.

The good news is that we can completely eliminate this perverse cycle by simply lifting the ban on crude oil exports. By doing so, American oil producers will be able to sell their product on the global market for a higher price. While its easy to assume that this will raise gas prices, the truth is that basic supply and demand economics tells us it won’t. American oil producers will be incentivized to maximize output, which will, in turn, increase global supply and actually lower prices for Americans who buy gasoline from the global market.

In the 21st Century, Americans are still suffering under the misguided energy policies of the 1970s for no discernable reason. Its time that we embrace America’s ability to dominate the global oil market and let the American people benefit from it next time they go fill up.